- +91 7099067200

-

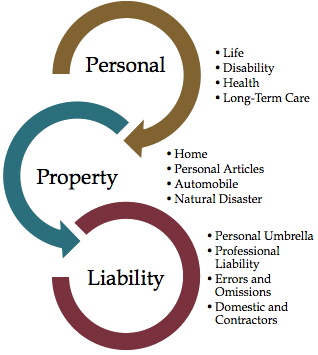

Insurance is an important risk management tool that can protect you and your family from financial hardship caused by unfortunate events. we work with you to identify your risks and implement a cost-effective risk management program that has been developed with your specific circumstances and requirements in mind.

If you have existing insurance arrangements, it is important to realise that both over-insuring and under-insuring can be costly. Your authorised planner will review these arrangements and ensure that you are appropriately & adequately Insured.

The lost earnings can be experienced with the death, disability, estate settlement costs and its clear impact is seen on the financial well being. By seeking the insurance planning assistance one can receive extensive relief in one’s overall financial status. Planning for covering all possible risks through insurance always turns out to be fruitful as well as satisfactory for each one of us.

Instead of considering insurance planning as an absolute tool towards the overall financial planning, we misunderstand it by Calling an investment. Already where our daily lives remain unpredictable with uncertainties including an absolute loss of income, critical illness or even with disability, why not look forward for the attainment of absolute peace of mind through an effective insurance planning technique.

You must be thinking how insurance planning is associated with financial planning? But the fact is that where financial planning is a way of formalizing goals over time and creating a path to accomplish the benefits, the relevance of insurance planning cannot be left behind. As insurance planning assists in protecting you from adverse financial crises or losses which come across towards your wealth management.

Life Insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upto the death of an insured person.

A Health Insurance policy reimburses the insured for medical and surgical expenses arising from an illness or injury that leads to hospitalization.

The tangible assets are susceptible to damages and to protect the economic value of the assets is needed. For this purpose ,general insurance products are bought as they provide protection against unforeseeable contingencies like damage and loss of the asset.

IntyGritty MoneyTree Pvt Ltd is a risk specialist and distributor of all kinds of Financial Products.

First of its kind in North-East, led by able professionals and advisors.

Corporate Office:

BR Arcade, 1st Floor

Janapath, Ulubari

Guwahati-781007, Assam

+91 7099067200

Copyright © Intygritty.com. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-174484 | Date of initial registration ARN – 19-Jan-2021 | Current validity of ARN – 18-Jan-2027

Grievance Officer- Intygritty Moneytree Private Limited | [email protected]

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors