- +91 7099067200

-

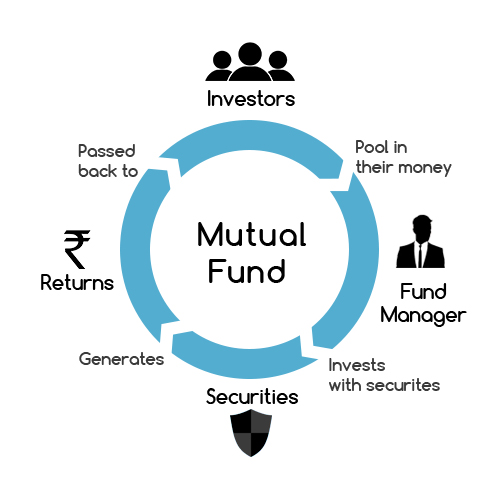

A mutual fund is formed when capital collected from different investors is invested in company shares, stocks or bonds. Shared by thousands of investors (including you), a mutual fund is managed collectively to earn the highest possible returns. The person driving this investment vehicle is a professional fund manager.

Investing in a mutual fund is like an investment made by a collective. An individual as a single investor is likely to have lesser amount of money at disposal than say, a group of friends put together. Now, let’s assume that this group of individuals is a novice in investing and so the group turns over the pooled funds to an expert to make their money work for them. This is what a professional Asset Management Company does for mutual funds. The AMC invests the investors’ money on their behalf into various assets towards a common investment objective.

Hence, technically speaking, a mutual fund is an investment vehicle which pools investors’ money and invests the same for and on behalf of investors into stocks, bonds, money market instruments and other assets. The money is received by the AMC with a promise that it will be invested in a particular manner by professional managers (commonly known as fund managers). The fund managers are expected to honour this promise. The SEBI and the Board of Trustees ensure that this actually happens.

It involves detailed review and analysis of all facets of your financial situation and strategies for your current goals.

Goal-based planning is a process to link to what you want out of life and the framework for your financial decisions to help you reach these dreams.

Second opinion secondary advice to help you resolve queries pertaining to pre-existing investments done and changes if may related to ever-changing market.

IntyGritty MoneyTree Pvt Ltd is a risk specialist and distributor of all kinds of Financial Products.

First of its kind in North-East, led by able professionals and advisors.

Corporate Office:

BR Arcade, 1st Floor

Janapath, Ulubari

Guwahati-781007, Assam

+91 7099067200

Copyright © Intygritty.com. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-174484 | Date of initial registration ARN – 19-Jan-2021 | Current validity of ARN – 18-Jan-2027

Grievance Officer- Intygritty Moneytree Private Limited | [email protected]

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors