- +91 7099067200

-

An important category of products that are necessary to diversify the risk in a portfolio, fixed income investments or securities have a fixed and guaranteed income and are for a fixed tenure. Ideal for risk averse individuals and when goals are approaching, this class of investments is relatively safe and can often provide ensure a steady stream of income with low or zero volatility. We have a logical and detailed approach of analyzing, evaluating and comparing different offerings in this class of asset to be able to offer the most suited product to our clients.

Fixed-income securities provide steady interest income to investors throughout the life of the bond. Fixed-income securities can also reduce the overall risk in an investment portfolio and protect against volatility or wild fluctuations in the market. Equities are traditionally more volatile than bonds therefore their price movements can lead to bigger capital gains but also larger losses. As a result, many investors allocate a portion of their portfolios to bonds to reduce the risk of volatility that comes from stocks.

It's important to note that the prices of bonds and fixed income securities can increase and decrease as well. Although the interest payments of fixed-income securities are steady, their prices are not guaranteed to remain stable throughout the life of the bonds.

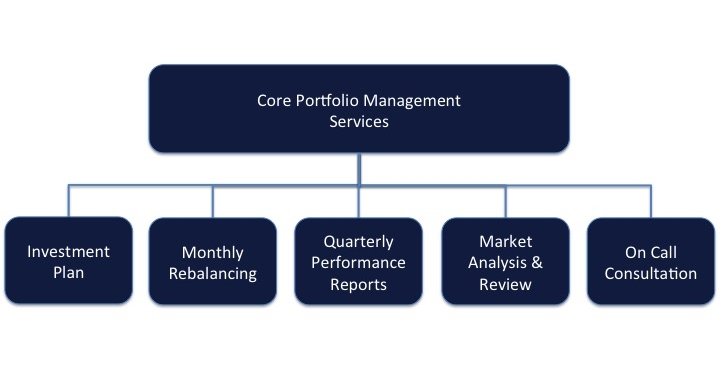

Portfolio Management Services (PMS), service offered by the Portfolio Manager, is an investment portfolio in stocks, fixed income, debt, cash, structured products and other individual securities, managed by a professional money manager that can potentially be tailored to meet specific investment objectives.

IntyGritty MoneyTree Pvt Ltd is a risk specialist and distributor of all kinds of Financial Products.

First of its kind in North-East, led by able professionals and advisors.

Corporate Office:

BR Arcade, 1st Floor

Janapath, Ulubari

Guwahati-781007, Assam

+91 7099067200

Copyright © Intygritty.com. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-174484 | Date of initial registration ARN – 19-Jan-2021 | Current validity of ARN – 18-Jan-2027

Grievance Officer- Intygritty Moneytree Private Limited | [email protected]

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors